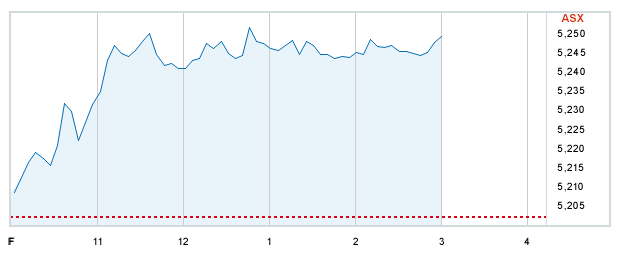

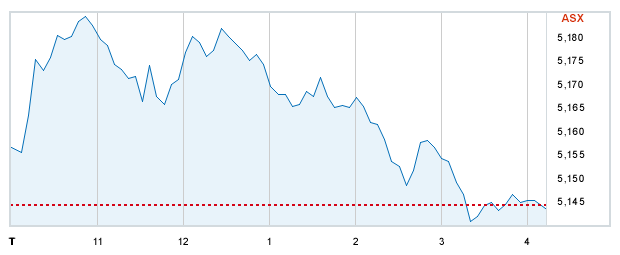

- The Australian market opened with 0.1 per cent of dip at 5,352.40 while the broader All Ordinaries opened at 5,353.90 (-4.1 points). Australian stocks dipped 0.1 per cent on last trading day of the year and ended the year up more than 15 per cent, biggest annual gain in four years.

- The market closed two hours early for New Year's eve as investors are more focussed on holiday celebrations.

- Australian dollar was trading a bit stronger against US dollar. Presently, the local currency (AUD) is trading at 89.32 US cents.